ALM Modeling

Overview

Transform your credit union’s interest rate risk management.

The Asset/Liability Management (ALM) Modeling module within ALM360 simulates and analyzes how changes in interest rates, market conditions, and policy limits affect a credit union’s balance sheet. Built for today’s regulatory and strategic demands, ALM Modeling delivers actionable insights for Asset/Liability Committees (ALCO), boards, and finance teams.

What is the ALM Modeling module in ALM360?

ALM Modeling is the backbone of ALM360’s integrated balance sheet management platform. It provides instrument-level granularity for institutions that require detailed and insightful analysis. It enables credit unions to:

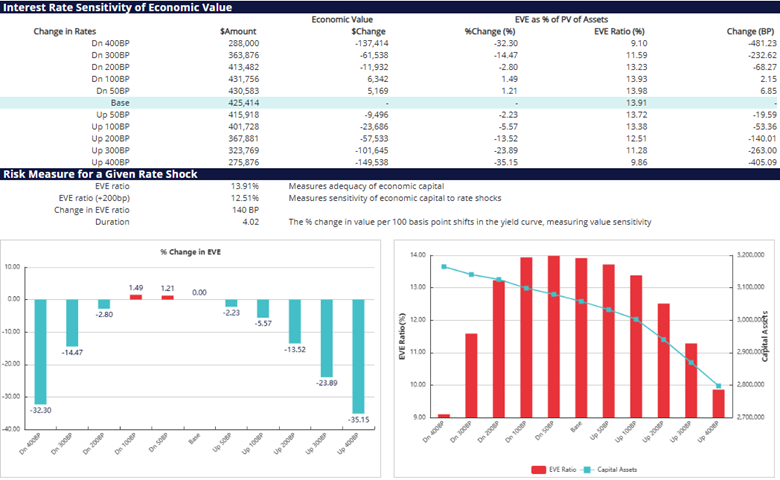

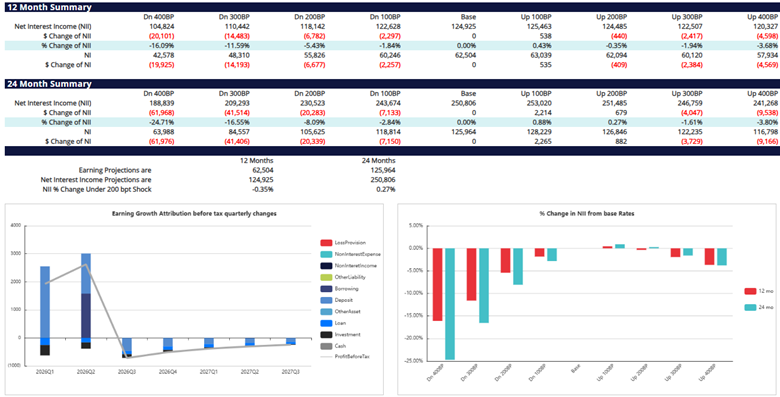

- Simulate Net Economic Value (NEV), Net Interest Income (NII), and Net Income across various interest rate paths and time horizons

- Assess interest rate risk, policy limits, and sensitivity with granular detail

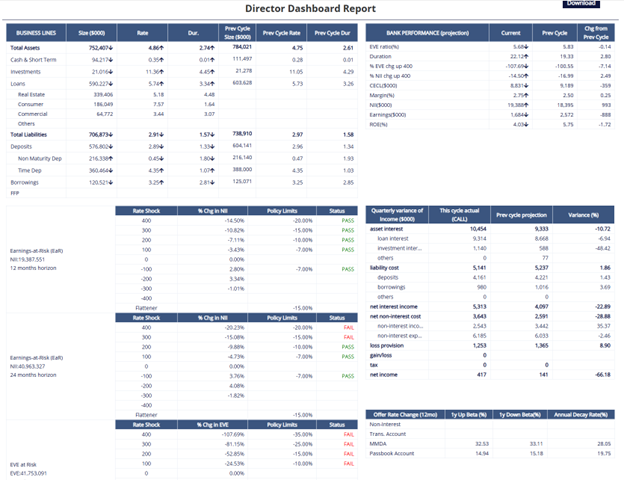

- Visualize compliance and risk scenarios in executive dashboards designed for ALCO and board reporting

What are the key features and benefits of ALM Modeling?

Comprehensive scenario analysis

Model multiple interest rate scenarios and stress tests to understand potential impacts on earnings and economic value. Apply custom assumptions for more accurate forecasting.

Policy limit monitoring

Track and visualize policy compliance in real time. Set alerts for breaches and monitor sensitivity to changing market conditions.

Executive dashboards

Interactive dashboards for ALCO and board meetings. Consistent, transparent numbers for every stakeholder.

Instrument-level granularity

Modeling is performed at the instrument level, allowing for targeted analysis and the ability to Identify risk areas and opportunities for optimization.

Seamless integration

Unified data model powers all ALM360 modules, ensuring decision consistency and eliminating manual reconciliation.

Suitable for credit unions of all sizes

Full instrument-level ALM Modeling supports complex balance sheets and meets all regulatory requirements.

ALM Report Previews

Why choose the ALM Modeling module?

Unified Platform

The ALM Modeling module is the backbone that unlocks the full potential of ALM360, including enhanced modeling, trading, reporting, benchmarking, and optimization capabilities.

Strategy Enablement

ALM360 turns ALM Modeling into a strategic tool by integrating results across liquidity, profitability, and CECL in real time. It enables credit unions to run stress scenarios, link risk analysis to trade execution, and forecast multiple financial simulations, all within one platform. This makes ALM outputs actionable for growth strategies, funding decisions, and board-level governance rather than just regulatory compliance.

FAQs

ALM modeling is a process credit unions use to measure and manage interest rate risk across their balance sheet. It involves simulating how changes in market rates and member behavior affect key metrics like Net Economic Value (NEV), Net Interest Income (NII), and overall profitability. By running multiple scenarios and stress tests, credit unions can forecast earnings, monitor policy limits, and ensure regulatory compliance. ALM Modeling supports strategic decisions on pricing, funding, and investment by showing the long-term impact of different strategies under varying economic conditions. Ultimately, it helps credit unions balance risk and return while maintaining financial stability and member value.

It provides full, instrument-level interest rate risk forecasting, all embedded within the broader ALM360 platform, unlocking powerful tools for credit unions to inform strategy and better manage their balance sheets.

Ready to see ALM360 in action?

Book an ALM360 demo with QuantyPhi today and discover how the ALM Modeling module can transform your credit union’s risk management and strategic planning.

More to Explore

ALM360: The Unified Balance Sheet Management Platform for Credit Unions

By Adam Stone

President of QuantyPhi

Investing with Purpose Starts at the Source

As credit union investment portfolio managers, our primary function is to act as stewards of other people’s money.

Learn More About Beastro

Corporate Central's next-generation, all-in-one platform built to transform how credit unions manage financial transactions, interactions, and cash flow.

CECL Validations: Beyond the Numbers

This article aims to highlight the importance of having your CECL process validated by an experienced and independent third party.